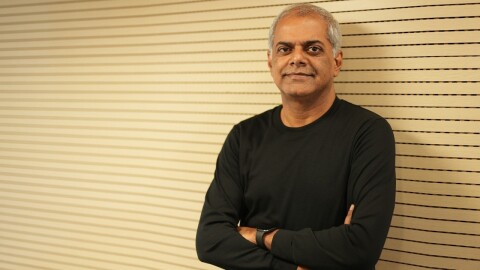

Three years ago, Amazon India launched Amazon Pay, intended to convert more consumers into digital payments users, in a market where 85% of transactions are cash-fulfilled. Rather than go down a piecemeal approach, Amazon Pay was devised to be a digital payments experience, encapsulating instruments such as UPI and wallets, as well as newer offerings such as our co-branded credit cards too. “The focus is on making the experience as trusted and convenient as the most preferred alternative which for a lot of customers is today cash,” says Mahendra Nerurkar, General Manager and Director, Amazon India, who is architecting Amazon Pay in the country.

India is at the cusp of a digital payments revolution and Amazon Pay hopes to lead the way. According to an estimate from financial services giant Credit Suisse, India’s digital payments market is expected to explode from around $200 billion to $1 trillion by 2023.

Having built India’s largest comparison shopping site Junglee, managed global product and pricing for Amazon and launched the used and refurbished unit on Amazon In, he is now turning his attention to fixing Indian ecommerce’s most vexing problem. “The critical process of transacting and paying for products (and having it delivered) online is broken,” he adds. “People with digital payments options ranging from credit cards to UPI, see one in four transactions fail.” If cash on delivery was a workaround, it was a costly one, with a high percentage of returns and each transaction costing over Rs 40 to process.

From COD to Cash Loads

To find a workaround, Amazon has innovated with its digital payments offerings, introducing cash loading to allow people to avoid the hassles of keeping the exact change (a time sink for the customer and the delivery agent) at the time of delivery. Any cash balance is transferred to an Amazon Pay account. Nerurkar wants this to be gateway and catalyst do digital purchases on Amazon and beyond. “Over 40% of our cash on delivery transactions now involve this cash load service,” he says. In developed markets, the rails for online payments were laid first with the introduction and widespread use of cards and other digital payments online. In India, payments is playing catch-up with an exploding market.

To try to propel this growth, Nerurkar says that the long-term future lies in pushing more consumers in the country towards digital payments. “Imagine a world where I don’t have to look at my bank balance before making a payment (because of the availability of plentiful, cheap credit), or I can split a high-value purchase into monthly instalments, or unhesitatingly make credit card payments because they are protected by card-issuing companies,” he says. “In the developed market, these rails are firmly laid.”

Building out a high-quality service

As digital payments races to catch up with a burgeoning market, Amazon is focussed on building out a high-quality service to tap this growth. To do this, Nerurkar and his team are being contrarians, looking away from singe products (UPI, for example, exceeded debit card transactions for the first time in September this year), instead, focusing on devising more holistic solutions for the Indian market. In this case, Nereurkar recognises the big impact UPI transactions have made but contends Amazon Pay’s focus continues to be on market-leading transaction success rates and consumer ratings. “UPI is a great tech trend at just the right time since it created an experience which works seamlessly compared to traditional net banking and works across a large number of banks and accounts,” he says. “However, the experience bar on UPI needs to be raised and customers are yet to see success for non-incentivized merchant transactions. Instead, Nerurkar says that Amazon Pay provides a more robust option, with the lowest failure rates and smoothest refund processes for digital payments users.

For Amazon, the future of payments is digital.