So, it’s official, the Amazon Pay ICICI Bank credit card has struck the right chord with consumers as an example of how companies like Amazon, ICICI and Visa are co-innovating with the consumer experience in mind. And over two million consumers who are already using this card are loving it.

Whether shopping online or at a physical store, consumers love rewards, offers and cashback schemes. As consumers move more towards buying online, they are looking for the same rush of getting a good deal or earning points and cashback. At the intersection of online shopping and physical stores are payments using credit cards.

The ‘Amazon Pay ICICI Bank' credit card, powered by Visa was introduced in 2018 and has witnessed encouraging acceptance from across the country, majorly from cities including Delhi NCR, Mumbai, Pune, Bengaluru and Hyderabad. It is very popular among millennials and sees maximum spends across online marketplaces, departmental stores and insurance premium payments.

The Amazon Pay ICICI Bank credit card has received an exciting response from customers across the country.

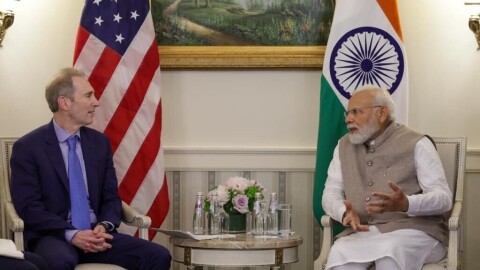

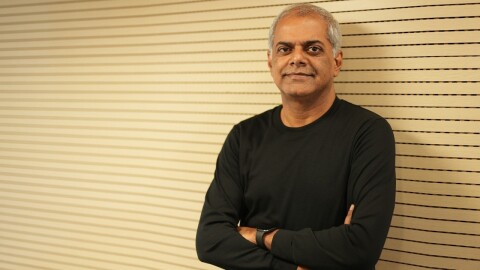

In fact, in July 2021, the bank had issued over two million of these credit cards, making it the fastest co-branded credit card to cross this milestone in India. Mr. Sudipta Roy, Head – Unsecured Assets, ICICI Bank said, “The Amazon Pay ICICI Bank credit card has received an exciting response from customers across the country. The best-in-industry rewards, seamless access to credit and the easy on-boarding process are the key contributors of this excitement. We believe the card is well poised to become the largest co-branded credit card in the country.”

What makes the Amazon Pay ICICI Bank credit card so popular? Three well-thought-out advantages that combine Amazon’s skill in understanding customer behavior and ICICI’s prowess in constructing financial products.

It’s easy and simple to apply for, with a completely digital sign-up process

Being a fully digital process, customers can apply for the Amazon Pay ICICI Bank credit card on the Amazon.in website or mobile app. They get a digital card in a 100% contactless and paperless manner, with the KYC being completed on video. The physical card is also sent to the customer by ICICI Bank within a few days. Since October last year, the card has on-boarded over 80% of new customers without any physical interaction.

Unmatched and exciting rewards for both ICICI and Amazon customers

The Amazon Pay ICICI Bank credit card is a lifetime free credit card with no joining or annual fee, and offers unlimited reward points on card spends, with no expiry date on redeeming the points. The math is simple, each point converts to one Rupee, and is credited every month to the customer’s Amazon Pay balance. They can redeem their earnings by purchasing from more than 16 crore items available on Amazon.in or with Amazon Pay partner merchants through transactions on flight tickets, booking hotels, food delivery, movie tickets and much more. ICICI Bank and Amazon Pay have also been continuously adding new features to the card to improve customer convenience.

It’s easy to rack up the points for both online and offline shopping

When shopping on Amazon.in, Prime members earn 5% reward points on every transaction and non-prime customers earn 3% reward points. When customers pay bills on Amazon.in like electricity, gas, recharges or book travel & movie tickets, they earn 2% reward points. They also earn 2% reward points for spends on Amazon Pay merchant offerings like Swiggy, Bookmyshow and Yatra. Customers also earn 1% reward points for any shopping spends in India where Visa cards are accepted. Additionally, customers get a fuel-surcharge waiver and no cost EMI offers on a large selection.