Women entrepreneurs, young professionals, and consumers in smaller towns emerging as key drivers of digital payments. Everyday transactions are shifting online, at an extraordinary pace, with Transaction volumes in FY25 rising 35% according to the How Urban India Pays 2025 report released today. The second edition of this comprehensive study, conducted by Kearney India in collaboration with Amazon Pay, reveals that digital payment preferences for offline purchases grew from 48% in 2024 to 56% in 2025, signaling India's rapid progression toward becoming a $7 trillion digital economy by 2030.

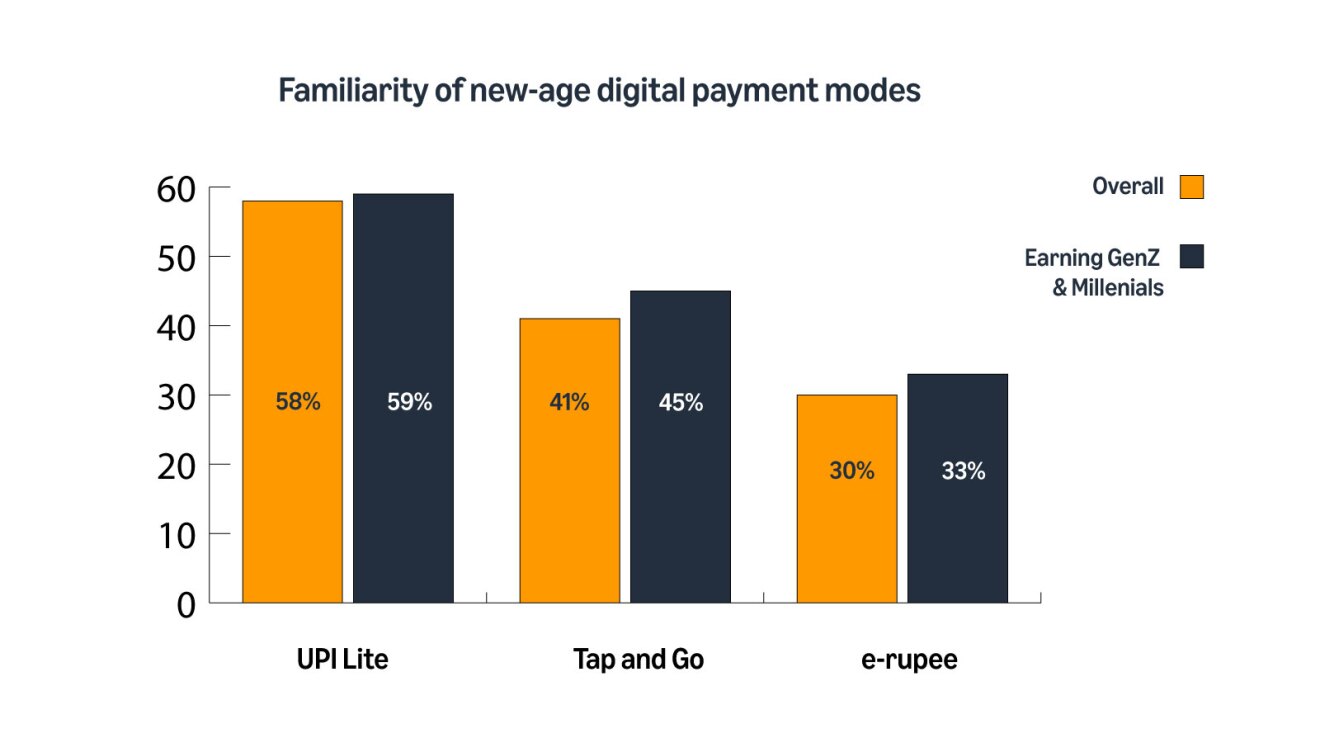

India’s digital payment surge is being powered by three pillars – rising customer adoption, government-led inclusion initiatives, and ecosystem-driven digital acceleration. Higher financial independence has also led to further awareness and experimentation as consumers continue to try new digital payment modes. Tap-and-go and UPI Lite catching on in metro cities with Gen Z and millennials who value ease of use through quick, contactless, no-PIN transactions—hinting at a growing appetite for smooth payment experiences.

Women entrepreneurs embrace digital payments

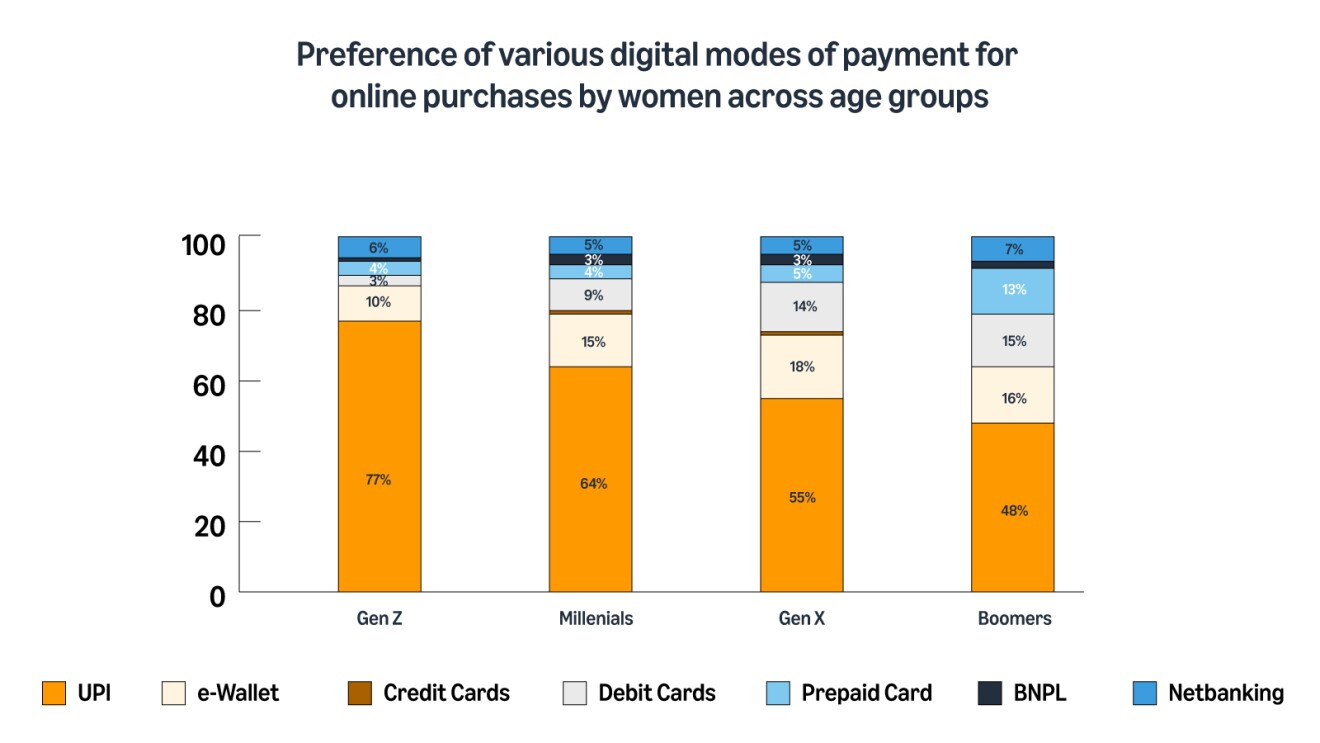

Women are emerging as key drivers of India’s digital payment revolution:

- 89% of women prefer digital methods for online purchases.

- 80% of women entrepreneurs now run their businesses using digital payment solutions

- UPI leads as their preferred payment method at 34%, followed by card payments at 20% and digital wallets at 8%.

As the digital revolution empowers women, 57% are taking charge of their finances, the report states, noting that affluent women favour credit cards (69%), while middle-class women prefer UPI and digital wallets.

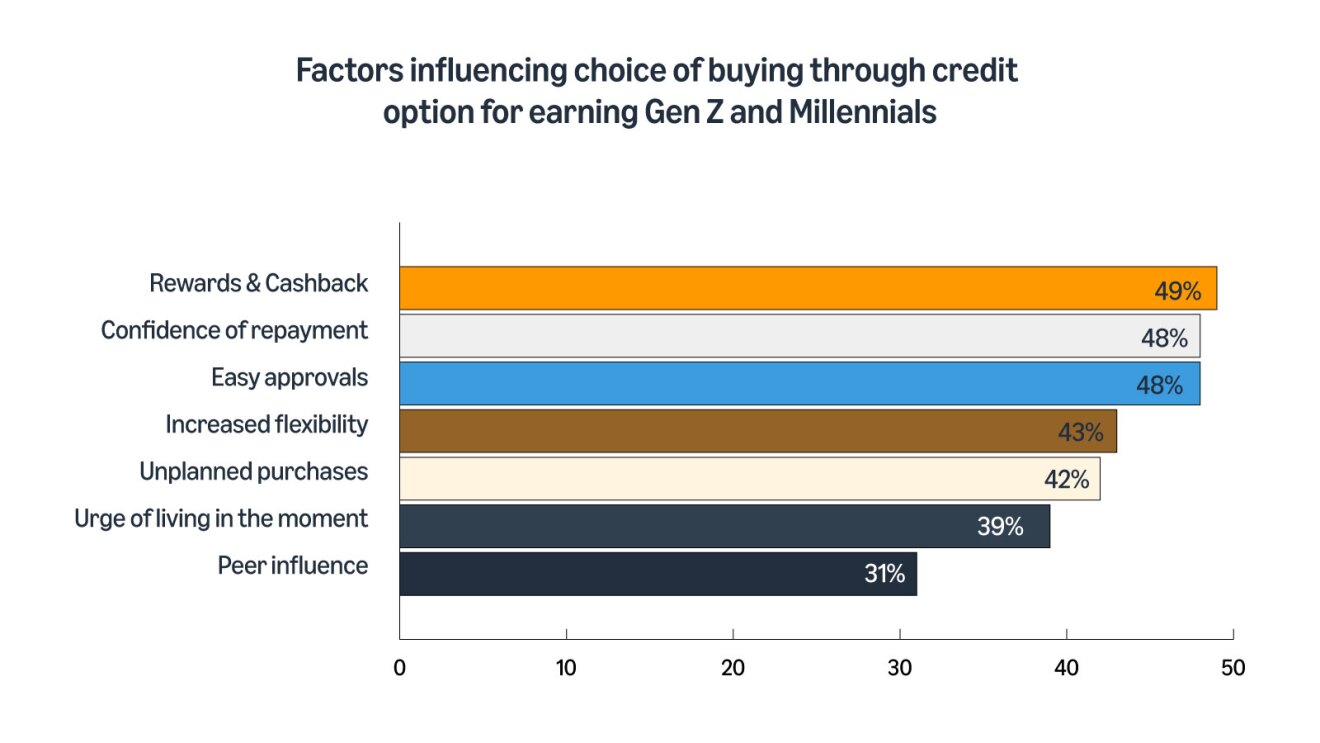

Gen Z and Millennials transform credit card usage

Young professionals are leading credit adoption in India:

- 65% young professionals apply for their first credit card immediately after starting their first job.

- Their primary motivations include managing expenses with a credit line (32%), earning cashbacks and rewards (30%), and building an early credit score (23%).

- 49% choose credit cards for cashbacks and rewards while maintaining responsible repayment habits.

“India’s digital payment revolution is accelerating at an unprecedented pace, with retail digital transactions set to cross $7 trillion well before 2030”, says Shashwat Sharma, Partner and Financial Services Lead, Kearney India. “Digital payments is preferred for 90% of online purchases and is rapidly reshaping offline spends too. Our consumer insights reveal that with growing financial independence, 57% of women are actively taking charge of their finances and 80% of women entrepreneurs now prefer to run their businesses cashless. Gen Z and Millennials are redefining credit adoption in India. 65% of respondents applied for their first credit card early in their careers.”

E-commerce is a catalyst in UPI, digital payments growth

According to the report, e-commerce has emerged as a major catalyst in how digital payment methods have been adopted by urban India.

- Users prefer cash and UPI for daily needs, whereas high-value categories such as furniture and durables like mobiles, home appliances, etc. continue to attract a high preference for credit cards.

- Payment functionality is now mainstream for platforms. More than 80% of respondents who use e-commerce marketplace/platforms for 3 or more services also rely on the platform for payment services.

- 65% of co-branded credit card users own e-commerce co-branded credit cards—making credit card transactions more accessible through everyday platforms and targeted rewards.

Digital payments spread beyond metros

The report finds digital payments are rapidly expanding into smaller urban centres:

- Digital payments for in-store purchases in small towns rose to 50% in FY25 from 42% in FY24.

- Metro cities continue with a rapid preference for online transactions and recorded 62% adoption.

- Cities such as Lucknow, Jaipur, Kochi and Bhubaneswar are leading this surge.

“India's payment landscape is evolving rapidly, and we're seeing this transformation across the entire nation, not just in metros," says Vikas Bansal, CEO of Amazon Pay India. "The growth in digital payment preference for offline transactions from 48% to 56% in just a year reflects a fundamental shift in consumer behaviour. The rising adoption of co-branded credit cards and the strong preference for digital utility bill payments, at 87%, signal a maturing digital payment ecosystem. At Amazon Pay, we're enabling this transition through our comprehensive suite of solutions - from UPI and wallet for daily transactions to our Amazon Pay ICICI Bank credit card and Pay Later options, making digital payments more rewarding and accessible for all Indians."

How India uses different payment methods

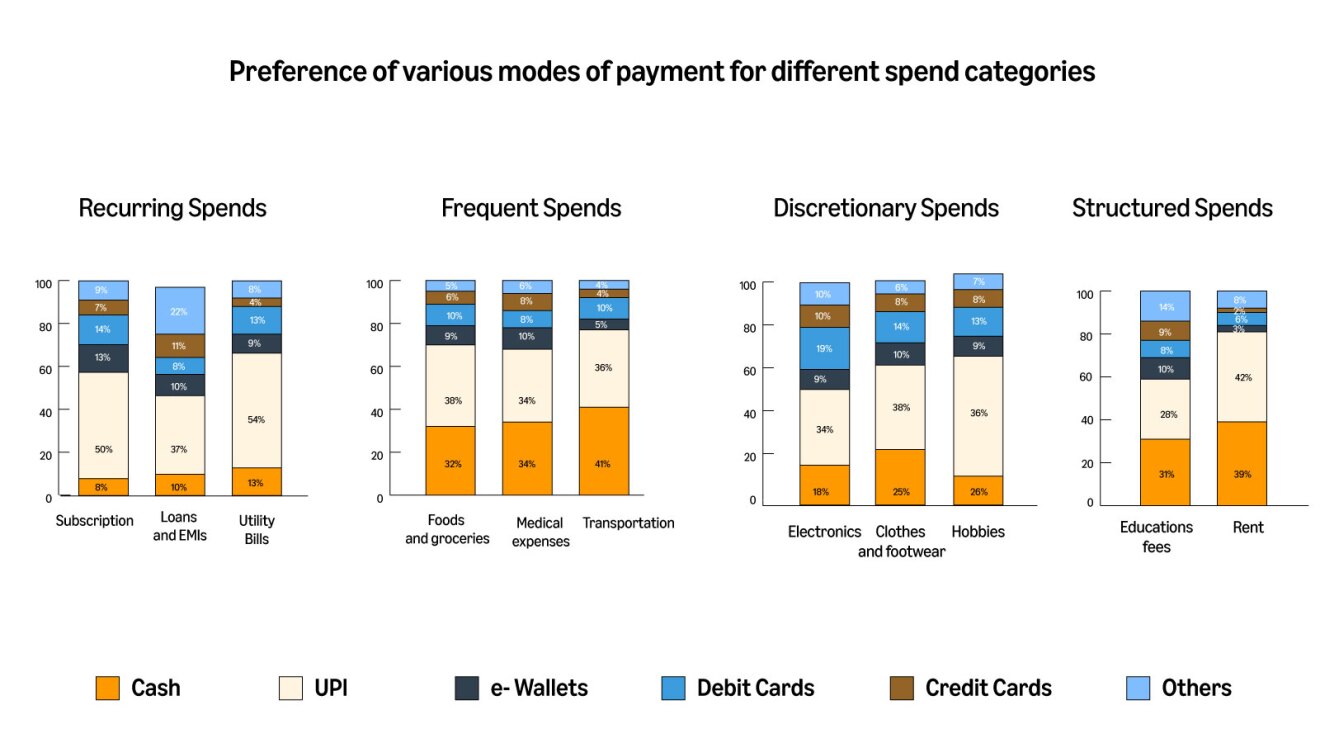

How Urban India Pays report identifies clear preferences across spending categories:

- Digital payments dominate when it comes to managing utility bills (87%) and subscriptions.

- Credit instruments lead high-value purchases in electronics (19%) and apparel (14%).

- UPI and cash remain preferred payment methods for daily expenses.

- Tap-and-go payments are also gaining popularity, now used by 21% of urban consumers.

Trust and convenience drive digital adoption

The study highlights key factors behind India's digital payment growth:

- 57% of users cite widespread acceptance as a reason for choosing digital payments.

- With multiple payment options available, 45% of respondents cited trustworthiness, 44% mentioned faster transactions, and 41% were motivated by better rewards when trying a new payment method.

- 61% of users stay loyal to their chosen payment method since it is convenient.

- Improved internet connectivity is supporting this shift, with only 31% of cash users now citing connectivity issues as a barrier, down from 51% last year.

Better financial literacy leads to better opportunities

Efforts by government bodies have been instrumental in encouraging digital payment adoption while addressing inclusion gaps.

- The Government of India’s Pradhan Mantri Gramin Digital Saksharta Abhiyan scheme trained more than 6.39 crore rural citizens by March 2024 in digital devices and cashless transactions.

- NPCI also conducts specialized workshops for the National Cadet Corps cadets, visually impaired individuals, and its blue-collar support staff on using UPI, RuPay, and Unstructured Supplementary Service Data.

- NPCI’s pre-sanctioned credit lines on UPI, developed with RBI, enable frictionless credit access for small businesses and individuals.

The report concludes that as India's payment ecosystem evolves, future growth will depend on strengthening security, creating personalised user experiences, and expanding financial literacy across all demographics.

To access the full How Urban India Pays 2025 report, click here.